How Can We Help?

How is GST managed when it comes to Support at Home funding?

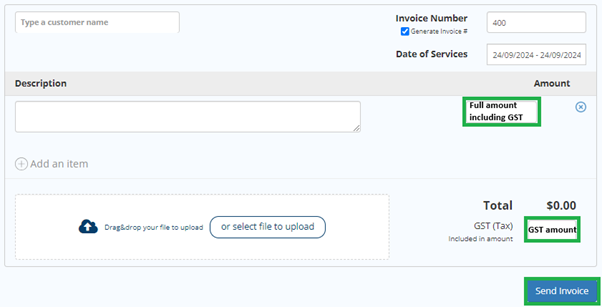

GST on goods and services provided under Support at Home cannot be paid directly from the Support at Home funding. Instead, GST should be clearly identified when invoices are uploaded, allowing Local Guardians to manage the GST payment separately.

This ensures that the GST portion is not drawn from the Support at Home funding, preserving those funds for the recipient to allocate towards additional care and services.

The full invoice amount, including GST, is paid to the service provider or reimbursement account in one deposit.